manipulyator-odintsovo.ru

Prices

Big Stocks Right Now

Find the latest stock market news from every corner of the globe at largest multimedia news provider, reaching billions of people worldwide every day. I wanted to know what others were investing in or looking into and waiting for the right opportunity to invest. Currently, I have: PLTR. UPWK. US stocks that increased the most in price ; TTOVX · D · +%, USD, M · ; QQMMM · D · +%, USD, K · Stock Ideas. Buy The DipBiggest Stock Gainers TodayBiggest Stock Losers Today StocksBest Penny Stocks to Buy NowBest Stocks Under $5Best Stocks Under $ Penny stock screener. Find the best penny stock companies with strong buy analyst ratings to buy today. Buy for a penny for the chance to leverage big. All stocksLarge-capSmall-capLargest Companies are sorted by daily volume and supplied with other stats to help you find out why they are so popular right now. U.S. Stock Movers ; Immersion Corp. (IMMR) · Immersion Corp. (IMMR). M · ; Big Tree Cloud Holdings Ltd. (DSY) · Big Tree Cloud Holdings Ltd. (DSY). K. Stock Movers ; PSNY · Polestar Automotive ; GLSTR · Global Star Acquisition, Inc. - Right ; BRACR · Broad Capital Acquisition Corp - Rights ; CNTB · Connect. That's right, you can buy shares of the New York Stock Exchange on the New York Stock Exchange. However, they also handle major trading volume for commodity. Find the latest stock market news from every corner of the globe at largest multimedia news provider, reaching billions of people worldwide every day. I wanted to know what others were investing in or looking into and waiting for the right opportunity to invest. Currently, I have: PLTR. UPWK. US stocks that increased the most in price ; TTOVX · D · +%, USD, M · ; QQMMM · D · +%, USD, K · Stock Ideas. Buy The DipBiggest Stock Gainers TodayBiggest Stock Losers Today StocksBest Penny Stocks to Buy NowBest Stocks Under $5Best Stocks Under $ Penny stock screener. Find the best penny stock companies with strong buy analyst ratings to buy today. Buy for a penny for the chance to leverage big. All stocksLarge-capSmall-capLargest Companies are sorted by daily volume and supplied with other stats to help you find out why they are so popular right now. U.S. Stock Movers ; Immersion Corp. (IMMR) · Immersion Corp. (IMMR). M · ; Big Tree Cloud Holdings Ltd. (DSY) · Big Tree Cloud Holdings Ltd. (DSY). K. Stock Movers ; PSNY · Polestar Automotive ; GLSTR · Global Star Acquisition, Inc. - Right ; BRACR · Broad Capital Acquisition Corp - Rights ; CNTB · Connect. That's right, you can buy shares of the New York Stock Exchange on the New York Stock Exchange. However, they also handle major trading volume for commodity.

We rank or compare stocks based on popular investment metrics and strategies to help you sort through companies from all major US equity markets. Pre-Market Stock Activity. now our only Underperform. A persistent risk is the dominance of bigger members, which command a large share of the sector's market cap and thus determine. Best Growth Stocks Right Now · Alphabet (NASDAQ:GOOGL) · Qualcomm (NASDAQ:QCOM) · MercadoLibre (NASDAQ:MELI) · Shopify (NYSE:SHOP) · PayPal Holdings (NASDAQ:PYPL). Best stocks to buy ; Coca-Cola, KO ; Cadence Design Systems, CDNS ; Thermo Fisher Scientific, TMO ; Diamondback Energy, FANG. stocks making the biggest moves over the last 5 days. View the latest top Barchart Exclusives stories, with a focus on today's important stocks, ETFs, and. 3) manipulyator-odintsovo.ru, Inc. (AMZN). Founded in in Seattle, Washington, Amazon is an e-commerce giant and cloud computing company. They are the world's largest. I think Alphabet (GOOGL) is the most undervalued stock in the stock market right now 5th largest financial institution in Brazil by market cap. Focus on. Now Best S&P Index Funds Best Stocks For Beginners How To Make Money From The CRSP US Large Cap Value Index is an index of large-cap growth stocks. The S&P index is market capitalization-weighted, where it gives a higher percentage allocation to companies with the largest market cap. A stock must meet. Large cap US companies ; AXP · D · B USD, USD ; AMGN · D · B USD, USD ; INTU · D · B USD, USD ; NOW · D · B USD, Comcast (CMCSA) Walt Disney (DIS) and Coca-Cola (KO) are some of the most trending Large Cap Stocks. See how they compare to other companies such as Oracle. U.S. STOCKS ; DJ Total Stock Market, , ; Russell , , ; NYSE Composite, , ; Barron's , , Trending Now. 1. My dream was to own a home in Puerto Rico—at 37, I bought an Stocks making big moves premarket: Nvidia, Salesforce, CrowdStrike and more. Nine of the 11 sectors had positive growth, with the biggest upside surprises coming from financials, health care and utilities, in addition to tech1. We think. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Updated world stock indexes. Get an overview of major world indexes, current values and stock market data Help© Bloomberg L.P. All Rights Reserved. Stocks ; 12, JPM, JPMorgan Chase & Co. B · ; 13, WMT, Walmart Inc. B · Top Gainers - United States Stocks ; Theriva Biologics. |TOVX. + ; Polestar Automotive Holding A. |PSNY. + ; Leslies. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation and other individual factors and re-.

Chime Free Withdrawal

Eligible members on Chime can overdraft up to $* on Chime debit card purchases and in-network ATM withdrawals fee-free. SAY GOODBYE TO MONTHLY FEES. Your. When we provided free overdraft, you collectively built up billions of dollars in savings. 1 Out of network ATM withdrawal and OTC advance fees may apply. You can withdraw money from your Chime card for free at over 60,+ ATMs across the country at stores like 7-Eleven, CVS, Walgreens, Circle K. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Although Chime has no physical locations, it does have a large fee-free ATM network that will meet most customers' in-person needs. While its savings account. We believe grabbing cash shouldn't cost you fees. So stick to U.S. Allpoint® ATMs, and you'll never pay a bogus ATM fee to withdraw cash. Our decision to expand fee-free ATMs~ is part of Chime's value proposition to members to charge no hidden fees~. “At first glance, the idea. The good part of this method is that not only are transfers between Chime users free of charge, but they're also fast, meaning you can send your friend some. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Eligible members on Chime can overdraft up to $* on Chime debit card purchases and in-network ATM withdrawals fee-free. SAY GOODBYE TO MONTHLY FEES. Your. When we provided free overdraft, you collectively built up billions of dollars in savings. 1 Out of network ATM withdrawal and OTC advance fees may apply. You can withdraw money from your Chime card for free at over 60,+ ATMs across the country at stores like 7-Eleven, CVS, Walgreens, Circle K. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Although Chime has no physical locations, it does have a large fee-free ATM network that will meet most customers' in-person needs. While its savings account. We believe grabbing cash shouldn't cost you fees. So stick to U.S. Allpoint® ATMs, and you'll never pay a bogus ATM fee to withdraw cash. Our decision to expand fee-free ATMs~ is part of Chime's value proposition to members to charge no hidden fees~. “At first glance, the idea. The good part of this method is that not only are transfers between Chime users free of charge, but they're also fast, meaning you can send your friend some. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder.

day. You can spend up · Limits start at $20 and · at 60,+ ATMs 1 nationwide · a daily ATM withdrawal limit · also withdraw cash by going · up to $ per day. In-app chat is the best way to learn about your personal cash withdrawal limits. All Members can withdraw $ per day at over 60k+ fee-free. Chime account basics ; Minimum balance for APY, N/A, $ ; Minimum deposit to open, $0, $0 ; Monthly maintenance fees, $0 · $0 ; ATM access, Over 60, fee-free. MoneyPass offers a surcharge-free ATM experience for qualified cardholders at a variety of convenient locations throughout the United States. Say goodbye to monthly fees when you bank through Chime. No overdraft fees. No minimum balance fees. No monthly fees. No foreign transaction fees. Surcharge-free ATMs at Publix. If your financial institution is a Presto! network member, you can access cash without paying ATM surcharge fees at over 1, Our decision to expand fee-free ATMs~ is part of Chime's value proposition to members to charge no hidden fees~. “At first glance, the idea. credited to your Direct Express · initially, but may be later · withdrawal. This is the addition · to $ per day. If · $3, Most financial institutions have. It is free to apply for a Chime checking account. However, certain minimal fees, like out-of-network ATM fees, exist. Chime has no minimum balance, monthly fees. Surcharge-free cash access Allpoint gives you freedom to get your cash how you want, without ATM surcharge fees, at over 55, conveniently-located ATMs. And. SpotMe on Debit is an optional, no fee service attached to your Chime Checking Account (individually or collectively, “SpotMe”). Eligibility for SpotMe requires. Fee-free ATM withdrawals: · Chime SpotMe offers overdraft protection: · Chime Checkbook: · Mobile Banking App: · Send Money: · Early Direct Deposit: · FDIC Insured. What are my limits for cash withdrawals? ATMs: You can withdraw up to $ per day at any ATM50 fee every time you make a withdrawal from an out-of-network ATM. Your Chime Checking Account comes with a debit card, no monthly fees or maintenance fees. Avoid out-of-network ATM fees and access to 60,+ fee-free ATMs —. Surcharge-Free In-Network ATMs · Withdraw cash, without worry. · More videos on YouTube · Get Cash Back When You Shop. · Find one near you. · Don't just take our. Never Pay Another ATM Surcharge! · Surcharge-free transactions · 55, ATMs Worldwide · No sign-up fees · Use your Current Stride Bank Debit Card · No forms to fill. Use your debit card anywhere in the U.S. that accepts Visa. If you need cash, there are more than 60,+ free ATMs through Chime's partner MoneyPass, at any. Chime allows customers to make free ATM withdrawals. Find out nearby free Chime ATMs. Finding Free Chime ATMs Near Me: A Complete Guide. Get spotted on debit card purchases and cash withdrawals Online Banking Your Chime SpotMe limit starts at $20 and may go up to $ depending on your.

What Should Your Stock Portfolio Look Like

Basically, this means having more than one asset class in your investment portfolio's holdings. This could include equities like stocks and funds, fixed-income. Having a balance of lower-risk assets like bonds and higher-risk assets like stocks allows a portfolio to grow while providing a cushion against volatility. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. Our five, professionally managed model portfolios are designed to simplify the investment selection and cover stable to aggressive risk tolerance levels. What do the future prospects look like? If you were buying this If you are on your own with your portfolio, this does make a real vacation difficult. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother. If an investment portfolio is more focused on equities, it will likely have higher risk and higher return expectations. Investing is all about balance. For your. If you're risk-averse, lean toward more conservative assets like bonds. If you're comfortable with more risk, you can allocate a larger portion to stocks. An. A portfolio should be diversified, and the degree of risk should hinge on your means and your age. If you're young, then you should be. Basically, this means having more than one asset class in your investment portfolio's holdings. This could include equities like stocks and funds, fixed-income. Having a balance of lower-risk assets like bonds and higher-risk assets like stocks allows a portfolio to grow while providing a cushion against volatility. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. Our five, professionally managed model portfolios are designed to simplify the investment selection and cover stable to aggressive risk tolerance levels. What do the future prospects look like? If you were buying this If you are on your own with your portfolio, this does make a real vacation difficult. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother. If an investment portfolio is more focused on equities, it will likely have higher risk and higher return expectations. Investing is all about balance. For your. If you're risk-averse, lean toward more conservative assets like bonds. If you're comfortable with more risk, you can allocate a larger portion to stocks. An. A portfolio should be diversified, and the degree of risk should hinge on your means and your age. If you're young, then you should be.

For example, if your asset allocation involves having 60% of your money in stocks or equities, you should diversify your portfolio to include foreign and. If you need your money in the near term, you should look for low-risk Even within asset classes like bonds and equities, the individual securities could be of. To make diversification work, your investments should be based on your goals and risk tolerance. This allows you to diversify your portfolio accordingly. For. Ensemble Capital believes that around 25 stocks is the level at which an additional stock provides little additional diversification benefit. I have been. Your portfolio should be well-diversified, with the appropriate mix of assets across the main asset classes of stocks, bonds, cash alternatives and alternative. Many financial advisors recommend a 60/40 asset allocation between stocks and fixed income to take advantage of growth while keeping up your defenses. does not espouse the concept. But what does true diversification look like? How do you take full advantage of its promise: lower risk for the same return. The 4 primary components of a diversified portfolio Stocks represent the most aggressive portion of your portfolio and provide the opportunity for higher. Diversification should go beyond the general categories of stocks, bonds and cash. Each of these can be split further into more specialized categories to take. While ultra-conservative, money market accounts and similar investments such as a short-term CD can provide stability and safety that other investment options. A diversified portfolio should include a mix of asset classes, diversification within asset classes, and adding foreign assets to your investment strategy. How to Diversify Your Portfolio. You should have some of all of the following: stocks, bonds, real estate funds, international securities, and cash. Why Is It. Stocks are the most common component of an investment portfolio. They refer to a portion or share of a company. It means that the owner of the stocks is a part. Usually expressed on a percentage basis, your asset allocation is what portion of your total portfolio you'll invest in different asset classes, like stocks. What Should My ETF Portfolio Look Like? A diversified portfolio will look Before making an investment decision you should consider with the assistance of your. A well-diversified financial portfolio should include stocks, bonds, other assets and of course, cash. Get to know these different types of investment tools and. The cash investment vehicles you use should be guided by the time you have before you plan to deploy it. Bank accounts or a traditional money market mutual fund. Your investment strategy should incorporate aspects of your personality. If youre generally anxious and watching your stocks closely, you may be better off. This is achieved by investing in a mix of asset classes like shares and bonds. Below you can see some examples of how your portfolio might look, from a cautious. Your overarching goal here should be to hold a mix of stock, bond, and cash investments that can generate growth, provide income, and preserve your capital.

Prime Trust Reviews

Indeed Featured review Whenever there is an opportunity to work with new technologies, we have the freedom to incorporate them into our workflow. There is. What's the difference between Fireblocks and Prime Trust? Compare Fireblocks vs. Prime Trust in by cost, reviews, features, integrations, and more. Employees rate Prime Trust out of 5 stars based on 79 anonymous reviews on Glassdoor. How can I get a job at Prime Trust? Prime Trust is a provider of all-in-one, financial infrastructure for fintech innovators. Their API platform includes Custody, Payment Rails, Liquidity. Claimed profile · Asks for reviews — positive or negative · Pays for extra features · Replied to 7 out of 7 negative reviews · Replies to negative reviews in. Prime Trust shall have no duty or responsibility to review or perform due diligence on any investments or other Custodial Property and will make absolutely. 92% recommend (67 Reviews). PrimeTrust Federal Credit Union profile picture PrimeTrust Prime Trust. May be an image of 1 person and text. May be an. Prime Trust (the Trust) as part of its annual review of publicly rated asset-backed commercial paper (ABCP) conduits. The confirmation is part of DBRS. 95% of employees at Prime Trust say it is a great place to work compared to 57% of employees at a typical U.S.-based company. Indeed Featured review Whenever there is an opportunity to work with new technologies, we have the freedom to incorporate them into our workflow. There is. What's the difference between Fireblocks and Prime Trust? Compare Fireblocks vs. Prime Trust in by cost, reviews, features, integrations, and more. Employees rate Prime Trust out of 5 stars based on 79 anonymous reviews on Glassdoor. How can I get a job at Prime Trust? Prime Trust is a provider of all-in-one, financial infrastructure for fintech innovators. Their API platform includes Custody, Payment Rails, Liquidity. Claimed profile · Asks for reviews — positive or negative · Pays for extra features · Replied to 7 out of 7 negative reviews · Replies to negative reviews in. Prime Trust shall have no duty or responsibility to review or perform due diligence on any investments or other Custodial Property and will make absolutely. 92% recommend (67 Reviews). PrimeTrust Federal Credit Union profile picture PrimeTrust Prime Trust. May be an image of 1 person and text. May be an. Prime Trust (the Trust) as part of its annual review of publicly rated asset-backed commercial paper (ABCP) conduits. The confirmation is part of DBRS. 95% of employees at Prime Trust say it is a great place to work compared to 57% of employees at a typical U.S.-based company.

Find the top alternatives to Prime Trust currently available. Compare ratings, reviews, pricing, and features of Prime Trust alternatives in Prime Trust Financial, Kingston, Jamaica. likes · 2 talking about Not yet rated (2 Reviews). Prime Trust Financial profile picture · Prime Trust. The preliminary ratings assigned by S&P Global Ratings to the prime floating-rate residential mortgage-backed securities (RMBS) to be issued by The New. Find helpful customer reviews and review ratings for Trust (Pulitzer Prize Winner) at manipulyator-odintsovo.ru Read honest and unbiased product reviews from our users. I am truly negative $ This seems to be a consistent issue with Prime Trust. I would make a debit card transaction, it would pull from my account, go back in. Working at Prime Trust LLC can be an exhilarating experience for employees, as they become part of a company that is at the forefront of financial innovation. Get more information for Prime Trust in Las Vegas, NV. See reviews, map, get the address, and find directions. PrimeTrust FCU Peace of Mind Checking Account Pros & Cons · No signup bonus. · Does not earn interest · Higher than average wire transfer fees. · Monthly service. Advertiser Disclosure: manipulyator-odintsovo.ru is committed to rigorous editorial standards to provide our readers with accurate reviews and ratings. We may receive. Reviews: Aug Pepecoin, Prime Trust, Stablecoins, and More. Prime Trust customer references have an aggregate content usefuless score of based on user ratings. Total ratings(). Prime Trust has an employee rating of out of 5 stars, based on 4 company reviews on Blind. They are rated the highest on Work Life Balance with out. The PrimeTrust FCU Mobile app gives you convenient and secure account access from your mobile device. The new and redesigned digital banking experience now. In , this audit and quarterly reviews were performed by Whitinger & Company. LLC. They determined that all of PrimeTrust Federal Credit Union's accounts and. Prime Trust's financial review. Prime Trust's Revenue (Yearly). M. Employees. Total Funding. M. Last Funding Round. M. See all Prime Trust's. This organization is not BBB accredited. Trust Company in Las Vegas, NV. See BBB rating, reviews, complaints, & more. Financing your hobby is easy with PrimeTrust! In fact, you can do it all online. PrimeTrust offers you a great rate every time. With a pre-approval, you can. Reviews of FlexJobs. Excellent · out of 5 · Consumer Reviews - Sitejabber. FlexJobs BBB Business Review. Partner Sites. manipulyator-odintsovo.ru Job Hunt. Get the FlexJobs. Looking for Muncie's best rates? You found 'em! Buying a car or truck is easy with PrimeTrust! In fact, you can do it all online. Join our exclusive webinar to gain insights into the Prime Trust collapse, explore your options, and safeguard your digital assets reviews? How was this.

Personal Loan Alternatives

BMG Money offers alternative lending programs for personal loans. Borrow via direct deposit, and repay in affordable installments. Savings Secured Loan. Use your shares at United to secure a short-term loan. Our lowest fixed-rate personal loan available; Flexible repayment options. Best personal loan alternatives to payday loans · Best for no credit: Oportun · Best for military members: Navy Federal Credit Union · Best for longer repayment. STEP 1: CONSIDER HOW YOU WILL USE YOUR PERSONAL LOAN. · DEBT CONSOLIDATION · COLLEGE TUITION · HOME IMPROVEMENTS · FURNITURE & APPLIANCES · GETTING MARRIED · HAVING. For whatever life brings your way, there's a loan for that. Unsecured personal loans, including no credit check payday loan alternatives, empower you with. Florida Credit Union can help achieve your financial goals through Personal Loans. Read more about personal loan options available and how to apply. PenFed was the only credit union that made our list. Its personal loan rates are some of the lowest on the market, and highly qualified borrowers can receive a. Best unsecured personal loans · SoFi: Best for fast funding. · Upgrade: Best for co-borrowers. · LendingPoint: Best for fair credit. · Prosper: Best for peer-to-. In this article, we'll throw some light upon some alternatives that you can use instead of unsecured personal loans. BMG Money offers alternative lending programs for personal loans. Borrow via direct deposit, and repay in affordable installments. Savings Secured Loan. Use your shares at United to secure a short-term loan. Our lowest fixed-rate personal loan available; Flexible repayment options. Best personal loan alternatives to payday loans · Best for no credit: Oportun · Best for military members: Navy Federal Credit Union · Best for longer repayment. STEP 1: CONSIDER HOW YOU WILL USE YOUR PERSONAL LOAN. · DEBT CONSOLIDATION · COLLEGE TUITION · HOME IMPROVEMENTS · FURNITURE & APPLIANCES · GETTING MARRIED · HAVING. For whatever life brings your way, there's a loan for that. Unsecured personal loans, including no credit check payday loan alternatives, empower you with. Florida Credit Union can help achieve your financial goals through Personal Loans. Read more about personal loan options available and how to apply. PenFed was the only credit union that made our list. Its personal loan rates are some of the lowest on the market, and highly qualified borrowers can receive a. Best unsecured personal loans · SoFi: Best for fast funding. · Upgrade: Best for co-borrowers. · LendingPoint: Best for fair credit. · Prosper: Best for peer-to-. In this article, we'll throw some light upon some alternatives that you can use instead of unsecured personal loans.

Best Personal Loans of August · Best Personal Loan Lenders · SoFi · LightStream · PenFed Credit Union · Avant · Prosper · Discover · First Tech Federal Credit. What Are the Best Low-Interest Personal Loans? · SoFi · LightStream · PenFed Credit Union · First Tech Federal Credit Union · Happy Money · Discover · Alliant Credit. Alternative (private) loans are administered and processed by private lending institutions to be used for educational costs. Alternative loans, also called private or supplemental loans, are made available by lenders to students who need additional funding to help with their. Learn whether a (k) loan, credit card, home equity loan or other financial product could meet your needs better than a personal loan. Collectively called alternative loans, these loan products may be available to assist a student who is not eligible for federal aid. A personal loan may not be the best financial option for you, so read on to discover the Guru's wisdom on alternatives below. An Alternative loan is a private education loan in the student's or sponsor's name that may require a co-signer depending on the applicant's creditworthiness. Prosper offers loans up to $40, for emergencies, major events, debt consolidation, or purchases. Online or call Best Egg offers personal loans. We assess the various alternatives to Personal Loans or secured loans that you can consider when you need funds urgently. What Are The 7 Best Alternatives To Personal Loans? · Loan against Public Provident Fund (PPF): · Loan against Employee Provident Fund (EPF): · Loan against. Personal loans provide more flexibility and predictability, which is important when you are taking on debt and needing to repay it on time. Private student loans are not based on financial need. ELMselect is a useful tool in learning loan fundamentals and comparing rates. Select from the UMD. Alternative Loan Disclosures. *Please Note: The University of Massachusetts Disclosure Statement Concerning Lenders for Private/Alternative Student Loans: Loans · Auto Loans · Personal loans · Home loans · FAIR Mortgage · Credit Score Builder · Safe Act Disclosure · Help with Financial Hardship · Become a member. Personal Loan Options · Signature Loan. Our Signature Loan is a great way to pay for that improvement project you've been planning for your house, or to afford. In addition to federal and university loans, other education loan options may also be available. You can't get a personal loan through Chase. Fortunately, you have many personal loan lenders to choose from. Here is a look at some available options: Loan against fixed deposits, These are securitized loans as they are backed by the FDs that you have.

Mortgage Payments Interest Only

An Interest-Only Mortgage is a home loan that gives you the option to pay only the interest on the principal amount for a set period of time. After the interest. A fixed rate mortgage has the same payment for the entire term of the loan. Use this calculator to compare a fixed rate mortgage to Interest Only Mortgage. Interest-Only Mortgage Calculator. This tool helps buyers calculate current interest-only payments, but most interest-only loans are adjustable rate. An interest-only loan is a loan in which the borrower pays only the interest for some or all of the term, with the principal balance unchanged during the. An interest-only mortgage starts with payments that only pay down the mortgage interest. Generally, this makes your monthly payments lower than a typical. with an interest-only mortgage, your monthly payments are much cheaper so you put the extra cash into a bank account with a good interest rate. At its most basic, an interest-only mortgage is one where you only make interest payments for the first several years—typically five or 10—and once that period. However, with an interest-only mortgage, borrowers only pay the interest on their home loan for a period that generally ranges from five to ten years. After. To calculate the payment you'll make on an interest-only loan, multiply the loan balance by the annual interest rate, then divide by For example, say you. An Interest-Only Mortgage is a home loan that gives you the option to pay only the interest on the principal amount for a set period of time. After the interest. A fixed rate mortgage has the same payment for the entire term of the loan. Use this calculator to compare a fixed rate mortgage to Interest Only Mortgage. Interest-Only Mortgage Calculator. This tool helps buyers calculate current interest-only payments, but most interest-only loans are adjustable rate. An interest-only loan is a loan in which the borrower pays only the interest for some or all of the term, with the principal balance unchanged during the. An interest-only mortgage starts with payments that only pay down the mortgage interest. Generally, this makes your monthly payments lower than a typical. with an interest-only mortgage, your monthly payments are much cheaper so you put the extra cash into a bank account with a good interest rate. At its most basic, an interest-only mortgage is one where you only make interest payments for the first several years—typically five or 10—and once that period. However, with an interest-only mortgage, borrowers only pay the interest on their home loan for a period that generally ranges from five to ten years. After. To calculate the payment you'll make on an interest-only loan, multiply the loan balance by the annual interest rate, then divide by For example, say you.

An interest-only mortgage is a type of mortgage in which the mortgagor (the borrower) is required to pay only the interest on the loan for a certain period. We know that rates on interest-only mortgage may be fixed for a year period but it can also change as often as every month. We can help you understand. Compare an interest-only vs. traditional mortgage An interest-only mortgage may be enticing due to lower initial payments than a traditional mortgage. However. Interest-only mortgages allow you to defer principal payments and just pay the interest for a set time, typically ranging from seven to 10 years. Then, you pay. An interest-only mortgage is a home loan with a unique perk: For a few years, you can make very low payments that only cover interest. With interest only mortgage you pay only interest on a loan for a set period of time. Explore the interest only home loan options from Chase and get. Enter: interest-only mortgage payments. Simply put, an interest-only mortgage payment is when the borrower only pays interest on their monthly payments for. This calculator will compute an interest-only loan's accumulated interest at various durations throughout the year. These amounts reflect the amount which would. In the simplest terms, an interest-only mortgage requires the borrower to make payments solely on the interest due on the loan monthly rather than both the. This interest only loan calculator figures your monthly payment amount for any interest only loan. Just two simple inputs makes the math easy for you. As the name suggests, an interest-only mortgage is a loan which requires the borrowers to pay only interest for the first few years of the loan's term. That. The advantage of an interest-only loan is a lower payment. The disadvantage is your loan amount will not go down with each payment, since the principal amount. Interest only mortgages were intended for developers and people doing housing renovations to flip the house. Basically you're trying to minimize. An Interest-Only mortgage allows you to only make interest payments for a fixed term. This term is usually between 5 to 10 years. A mortgage is “interest only” if the scheduled monthly mortgage payment – the payment the borrower is required to make --consists of interest only. A “Cash-Out” IO mortgage loan would offer Interest-Only payments. It makes borrowing money even cheaper (think of it like a bank account) and allows you to make. An interest-only loan might be advantageous if the borrower has an uneven stream of income (commissions), if the borrower expects to have an increase in income. The total number of years over which you will make payments on this mortgage. This calculator assumes that after any interest only period has expired, the. An interest-only loan is simply a loan where the borrower is obligated to pay only the interest on the loan for a certain period of time. A typical mortgage payment consists of both interest and principal, but with an interest-only mortgage, borrowers have the opportunity to only pay interest for.

Stripe Chargeback Rate

By automating chargeback disputes through Stripe's integration with Chargehound, Cleo has been able to automatically contest fraudulent chargebacks, resulting. This is because the dispute fee is used to cover the administrative and processing costs necessary to handle the dispute. To learn more, please see Stripe's. Anything over 1% is problematic, but it's somewhat based on the time period and ratio of chargebacks to total orders ($ amount doesn't matter). This fee is deducted from your school's payout but is returned to the school if the school wins the chargeback dispute. You can view chargeback fee deductions. Note: Stripe charges a £20 chargeback fee for all disputes, won or lost, and we will have to charge this to your account in cases where a client opens a dispute. The card issuer creates a formal dispute which immediately reverses the payment. The payment amount, along with a separate dispute fee levied by the card. The dispute rate for this week would be 2% (2 disputes on payments). If a User's chargeback rate reaches % this is then when Stripe has to get involved. Visa and MasterCard tolerate up to % dispute rate. If you get 1 dispute for 5 payments, that's already 20%. Stripe will pull the red flag. Solopreneurs got. Apart from the double tragedy of revenue and merchandise loss, Stripe also charges a $15 fine for every customer dispute you get, as dispute processing fee. By automating chargeback disputes through Stripe's integration with Chargehound, Cleo has been able to automatically contest fraudulent chargebacks, resulting. This is because the dispute fee is used to cover the administrative and processing costs necessary to handle the dispute. To learn more, please see Stripe's. Anything over 1% is problematic, but it's somewhat based on the time period and ratio of chargebacks to total orders ($ amount doesn't matter). This fee is deducted from your school's payout but is returned to the school if the school wins the chargeback dispute. You can view chargeback fee deductions. Note: Stripe charges a £20 chargeback fee for all disputes, won or lost, and we will have to charge this to your account in cases where a client opens a dispute. The card issuer creates a formal dispute which immediately reverses the payment. The payment amount, along with a separate dispute fee levied by the card. The dispute rate for this week would be 2% (2 disputes on payments). If a User's chargeback rate reaches % this is then when Stripe has to get involved. Visa and MasterCard tolerate up to % dispute rate. If you get 1 dispute for 5 payments, that's already 20%. Stripe will pull the red flag. Solopreneurs got. Apart from the double tragedy of revenue and merchandise loss, Stripe also charges a $15 fine for every customer dispute you get, as dispute processing fee.

The payment amount, along with a separate dispute fee levied by the card network, is deducted from your account balance. There is a dispute resolution process. Radar scans every payment using thousands of signals from across the Stripe network to help detect and prevent fraud—even before it hits your business. Stripe's merits and demerits; Transaction Fees; Dispute Costs; Third-party Integration; Payment's Security; Which one is better? PayPal vs Stripe. Blog/. Stripe pricing works on a per-transaction basis and offers a fixed fee for each transaction. The base rate is % + 20p for European card transactions and %. The dispute fee for your country can be found on the Stripe Pricing page. This fee is deducted from your account balance when a cardholder initiates a dispute. Stripe, on the other hand, charges slightly more, asking for a $35 fee per chargeback. But where Stripe really shines is in its approach to prevention. Through. Bank of America's chargeback fee – $25 to $50 whenever the buyer files a chargeback. Shopify's chargeback fee – $15 per chargeback for U.S. merchants. Stripe's. To process a chargeback, the issuer creates a formal dispute on the card After that, Stripe debits your balance for the payment amount and dispute fee. This fee is deducted from your school's payout but is returned to the school if the school wins the chargeback dispute. You can view chargeback fee deductions. Tired of blocking payments due to high chargeback rates? We can help. By preventing chargebacks, we enable you to accept more payments without exceeding your. Stripe charges a $15 dispute fee for all chargebacks, but if the merchant wins the dispute, the fee will be refunded along with the disputed amount. How long. Stripe's chargeback protection program costs % per transaction on top of the standard Stripe rates. It may be tempting to shrug off the cost, but keep in. Stripe takes the initiative to reimburse you for the disputed transaction, exempts you from any chargeback fees, and makes the decision on whether to contest. Discover the impact of chargebacks on your standing with payment processors like Stripe and learn about the critical 1% threshold for inclusion on the MATCH. As we all know dispute rate seriously affects your ability to process the payments and anything over 1% will very likely blacklist your service in particular. The alert enables you to automatically refund transactions before turning into chargebacks. Significantly reducing your chargeback rate and maintaining a. Tired of blocking payments due to high chargeback rates? We can help. By preventing chargebacks, we enable you to accept more payments without exceeding your. lost indicates that the bank decided in the account owner's favor and upheld the dispute. In this case, the refund is permanent and the dispute fee isn't. Kount connects directly with your Stripe account to prevent and fight payment disputes automatically. Instantly recover lost revenue, increase your win rates. Does accepting the dispute cancel the dispute fee? No. Accepting effectively speeds up the dispute being marked as lost, but is otherwise no different from.

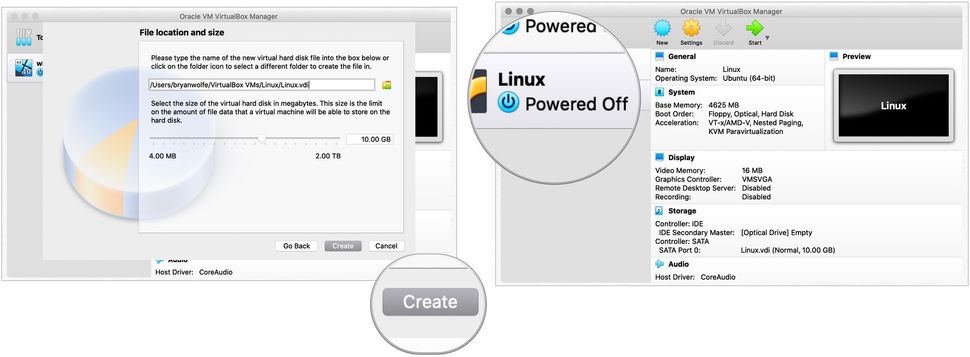

Learning Linux On Mac

Windows probably would have been easier to set up but I consider every configuration problem a learning experience and my freedom is worth more than my time. Before Linux enthusiasts start throwing rocks at me, I was and still am an avid Linux enthusiast with tens(or even hundreds) of hours spent. Yes, if you learn the Linux terminal, you can also use the Mac terminal. The Mac terminal is based on the Unix operating system, which is. If you use MacOS® X, you don't need to install a third-party client like PuTTY to connect to your cloud server by using Secure Shell (SSH). No macOS is not based on Linux. No, macOS is not entirely similar to Linux. Learn the similarities and differences between macOS and Linux. Learn where to download and manipulyator-odintsovo.ru on Windows, Linux, and macOS. Discover the dependencies required to develop, deploy, and manipulyator-odintsovo.ru apps. These tutorials apply to most Unix-based systems including Linux, Mac OS X, and more. Learn about navigation, running commands, automation, virtual machines. Learn the ways of Linux-fu, for free. Get updates about new courses and lessons! Our new mobile interactive and gamified approach makes it easy and fun to learn Linux usage from the basic, the app gives practical day to day knowledge and. Windows probably would have been easier to set up but I consider every configuration problem a learning experience and my freedom is worth more than my time. Before Linux enthusiasts start throwing rocks at me, I was and still am an avid Linux enthusiast with tens(or even hundreds) of hours spent. Yes, if you learn the Linux terminal, you can also use the Mac terminal. The Mac terminal is based on the Unix operating system, which is. If you use MacOS® X, you don't need to install a third-party client like PuTTY to connect to your cloud server by using Secure Shell (SSH). No macOS is not based on Linux. No, macOS is not entirely similar to Linux. Learn the similarities and differences between macOS and Linux. Learn where to download and manipulyator-odintsovo.ru on Windows, Linux, and macOS. Discover the dependencies required to develop, deploy, and manipulyator-odintsovo.ru apps. These tutorials apply to most Unix-based systems including Linux, Mac OS X, and more. Learn about navigation, running commands, automation, virtual machines. Learn the ways of Linux-fu, for free. Get updates about new courses and lessons! Our new mobile interactive and gamified approach makes it easy and fun to learn Linux usage from the basic, the app gives practical day to day knowledge and.

learning and create online courses on your Mac. Buy nowTry Includes major updates to support new versions of macOS, Windows, Linux, and new Mac models. Learn where to download and manipulyator-odintsovo.ru on Windows, Linux, and macOS. Discover the dependencies required to develop, deploy, and manipulyator-odintsovo.ru apps. Windows vs macOS vs Linux. Which is the Best Operating System for Web Design & Development? Learn the Pro's & Con's of each OS. While you learn Linux you need to realize that you will probably have to start over at least once, if not many times. For this reason I recommend you use a. macOS. To learn Linux commands on a Mac, use the Terminal. Open the Terminal by opening the Applications folder, then the Utilities folder. 1. Access the computer's terminal. · 2. Run the command below in the terminal: · 3. If a password is required after running the command, please enter your Mac's. So before getting started, make sure you have access to a terminal. Luckily, you have several options available to you here. Apple terminal If you are on a Mac. Linux shell, aka Bash! You How does Linux compare to MacOS and Windows? What kind of jobs use Linux? What else should I study if I am learning Linux? The thoughtful, capable, and ethical replacement for Windows and macOS. Copy it, learn from it, remix it, modify it, and redistribute it. Get Involved. Not all Linux users are able to use their primary platform all the time. At work, a situation such as corporate mandates can force you to use another. OS X should be sufficient to learn all that you need. Most of the GNU tools (and others) that make up the Linux user space, also run on OS X. It. Learn to use the command line in your MAC or Linux Computer. Beginning Linux and Mac terminal For the complete beginner, and for those who just need a quick refresh. If you use Linux as your primary OS. The command line course is mainly for Linux users but Mac users can also benefit though not everything is applicable to them. For beginners, the. Spin up Ubuntu VMs on Windows, Mac and Linux. Cloud-init. Control and customise your cloud instances. Landscape. Systems management and security patching for. team to acquire one, not only to write this tutorial and make it easy for you to install Linux Mint on it, but also for us to learn a bit more about some piece. PowerShell is not just for Windows anymore, it now runs on Linux and macOS too! Learn how to use PowerShell to have a single command line console and. Filezilla This illustration is from a Linux computer. macOS is similar. First click the Site Manager icon in the upper left. Site Manager Select New Site. Before Linux enthusiasts start throwing rocks at me, I was and still am an avid Linux enthusiast with tens(or even hundreds) of hours spent. Students will learn how to navigate in and work with the Apple's OS X and Linux environments. (GUI: Graphical User Interface and command line). Apple Computers.

Which Crypto To Invest In Right Now

Nvidia - Strong Buy, based on 43 analyst ratings, 39 Buy, 4 Hold, and 0 Sell. Block - Strong Buy, based on 25 analyst ratings, 21 Buy, 3 Hold, and 1 Sell. The first cryptocurrency was Bitcoin, which was founded in and remains the best known today. Much of the interest in cryptocurrencies is to trade for. Top 10 Cryptos to Invest In September · Bitcoin (BTC) · Ethereum (ETH) · Binance Coin (BNB) · Solana (SOL) · Ripple (XRP) · Dogecoin (DOGE) · Polkadot (DOT). Bitcoin (BTC) Bitcoin has been around for the longest of any cryptocurrency. It's easy to see why it's the leader, with a price and market cap that are much. Coinbase Bytes. The week's biggest crypto news, sent right to your inbox. Subscribe now buy or sell a particular digital asset or to employ a particular. Ways into crypto. Explore the growing number of opportunities to trade and invest in the emerging cryptocurrency universe. hidden. Our approach. Find the right. Pepe Unchained ($PEPU) is the best crypto to buy now because aside from being a meme coin carrying the Pepe theme, it now has its own Layer 2 blockchain. Bitcoin dips to $57, level and crypto stocks tumble to begin September trading: CNBC Crypto. watch now. Ethereum (ETH) – The Most Promising Crypto. Ethereum ranks above Bitcoin for some, thanks to its innovative smart contract technology. It is the second-largest. Nvidia - Strong Buy, based on 43 analyst ratings, 39 Buy, 4 Hold, and 0 Sell. Block - Strong Buy, based on 25 analyst ratings, 21 Buy, 3 Hold, and 1 Sell. The first cryptocurrency was Bitcoin, which was founded in and remains the best known today. Much of the interest in cryptocurrencies is to trade for. Top 10 Cryptos to Invest In September · Bitcoin (BTC) · Ethereum (ETH) · Binance Coin (BNB) · Solana (SOL) · Ripple (XRP) · Dogecoin (DOGE) · Polkadot (DOT). Bitcoin (BTC) Bitcoin has been around for the longest of any cryptocurrency. It's easy to see why it's the leader, with a price and market cap that are much. Coinbase Bytes. The week's biggest crypto news, sent right to your inbox. Subscribe now buy or sell a particular digital asset or to employ a particular. Ways into crypto. Explore the growing number of opportunities to trade and invest in the emerging cryptocurrency universe. hidden. Our approach. Find the right. Pepe Unchained ($PEPU) is the best crypto to buy now because aside from being a meme coin carrying the Pepe theme, it now has its own Layer 2 blockchain. Bitcoin dips to $57, level and crypto stocks tumble to begin September trading: CNBC Crypto. watch now. Ethereum (ETH) – The Most Promising Crypto. Ethereum ranks above Bitcoin for some, thanks to its innovative smart contract technology. It is the second-largest.

Since its inception, more than 21, different cryptocurrencies have evolved and followed in Bitcoin's footsteps. Ethereum and Tether sit behind Bitcoin in. Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 56, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $. Crypto ; BTC.1 · Bitcoin (CME) Front Month ; ETHUSD · Ethereum USD ; XRPUSD · XRP USD ; BCHUSD · Bitcoin Cash USD. Cryptocurrencies tend to be more volatile than more traditional investments, such as stocks and bonds. An investment that's worth thousands of dollars today. Ethereum (ETH). Ethereum (ETH) is another extremely popular asset that many crypto enthusiasts see as one of the best cryptocurrencies to invest in today for. 1. Tether. Tether (USDT) is one of the oldest stablecoins in the crypto market. · 2. USD Coin. USD Coin (USDC) is also pegged 1 to 1 to the USD. · 3. Binance USD. The first cryptocurrency was Bitcoin, which was founded in and remains the best known today. Much of the interest in cryptocurrencies is to trade for. Largest cryptocurrencies by market cap · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. BNB (BNB) · 5. Solana (SOL) · 6. USD Coin (USDC) · 7. XRP (XRP). While some buy into crypto for short-term speculation, for others, owning cryptos can be viewed as a kind of diversification away from traditional assets, like. Cryptocurrency investment potentials are expanding due to the rapid growth of blockchain technologies. More than 2, new cryptocurrencies are created and. Bitcoin (BTC) We can't publish a list of the best cryptocurrencies without mentioning Bitcoin. As the OG cryptocurrency (having launched in ), it is. Cryptocurrency. All Cryptocurrencies · Number of Cryptocurrencies:9, Total Cryptocurrency Market Cap: $T Vol (24H):$B Dominance: BTC: %ETH. Exchange-traded funds (ETFs) and mutual funds are available that provide exposure to spot cryptocurrency, cryptocurrency futures contracts, and companies. We urge you to be cautious in considering whether crypto asset investments are appropriate for you. Planning for the future starts right now! Free Financial. Dogecoin (DOGE) was developed in by software developer Billy Markus to put some humour in the crypto space. Although it was originally released as a joke. 30 Symbols · BTC-USD55,%. Bitcoin USD · ETH-USD2,%. Ethereum USD · USDT-USD%. Tether USDt USD · BNB-USD%. BNB USD · SOL-. Top Cryptocurrencies ; Bitcoin. 1|BTC. 56, % ; Ethereum. 2|ETH. 2, % ; Tether USDt. 3|USDT. +% ; BNB. 4|BNB. +%. For me the best for now, is Dogecoin and Shiba Inu coin. It seems like in future, it will become more valuable and actual. Continue Reading. What are the top 5 Best Cryptocurrency to Invest In in ? Top 5 Cryptocurrencies to Invest In: Updated Comparison Guide Bitcoin (BTC). SEI – A DEX-Powering Crypto. Another cryptocurrency project that can be considered the best crypto to buy right now is SEI. It is the first sector-specific.

What Mortgage Can I Afford First Time Buyer

Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. How much mortgage can I afford? The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Most first-time homebuyers can qualify for a first-time homebuyer loan with a credit score and a $1, down payment. Lenders will also look at your debt-to. In my case, $4,/month was my MAX but $4,/month was most realistic. From there, I only used the mortgage calculators on-line to figure out. TDS looks at the gross annual income needed for all debt payments like your house, credit cards, personal loans and car loan. Depending on the lender, TDS. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. How much mortgage can I afford? The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Most first-time homebuyers can qualify for a first-time homebuyer loan with a credit score and a $1, down payment. Lenders will also look at your debt-to. In my case, $4,/month was my MAX but $4,/month was most realistic. From there, I only used the mortgage calculators on-line to figure out. TDS looks at the gross annual income needed for all debt payments like your house, credit cards, personal loans and car loan. Depending on the lender, TDS. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources.

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Your purchase price: $, · Down payment: $36, (6% of the total purchase price, about the average for first-time buyers) · Loan term: year fixed · Loan. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. There are many factors that go into determining how much home you can comfortably afford — including your income, debt and desired down payment. Our. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. For the purposes of this tool, the default insurance premium figure is based on a premium rate of % of the mortgage amount, which is the rate applicable to a. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. A 20% DTI is easier to pay off during stressful financial periods compared to, say, a 45% DTI. Home-buyers who are unsure of which option to use can try the. The First-Time Home Buyer Incentive · Owning a homeOpen. Manage your Find an estimate of how much mortgage or rent you can afford. Debt service. However, a 50% debt-to-income ratio isn't going to get you that dream home. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To. Use our affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Deciding how much house you can afford If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you. To stay within an hour of my job the lowest priced liveable houses are around $k. Most mortgage calculators work out to a $$ monthly. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Lenders divide your total monthly debt payments by your income to determine whether or not you can afford another loan. The higher your down payment, the. The period of time it will take to pay off the principal amount of a mortgage. Find out how much home you can afford. Maybe you already know you want: 1. FHA home loans were created to help first-time homebuyers purchase a home. FHA calculators let homebuyers and homeowners understand what they can afford to.

1 2 3 4 5 6