manipulyator-odintsovo.ru

Overview

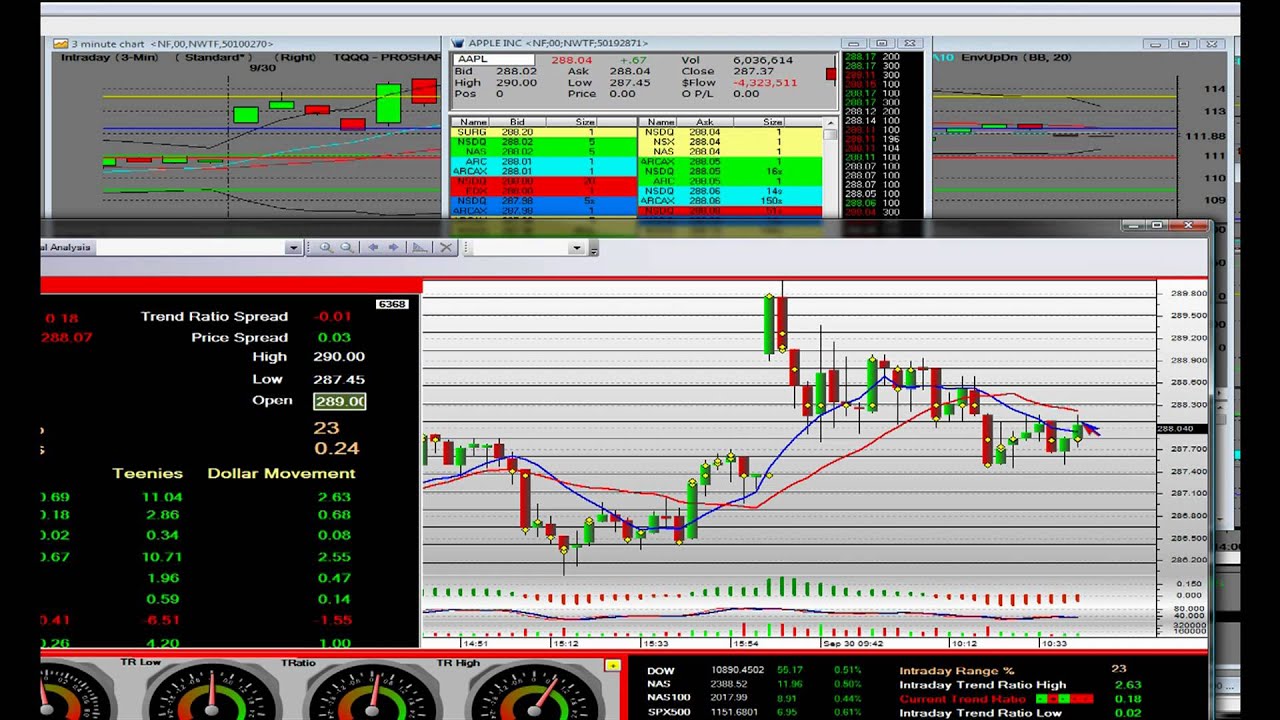

Make Money Day Trading Stocks

There are many confident online reports that a day trader can return profits of 10 percent each month, or no, wait, that's 18 percent per month or you get. Yes, day trading can be very lucrative. If you know what you are doing, it is possible to make a significant amount of money in a short time period. It can also. Can you make money with day trading? Discover practical tips & helpful strategies to be successful in day trading! Day trading as a side hustle is totally possible and can be very profitable but it's not easy and you need to put in the work! You know, before you do those. If you want to make your money work be a" trader" but never a "day trader." I trade plus times a year and mostly make money which I could live on. Back. Day trading is buying and selling stock within the same trading day. A day trader aims to profit from the market's daily moves. Surprisingly, the moves don't. Do you actively trade stocks? If so, it's important to know what it means to be a "pattern day trader" (PDT) because there are requirements associated with. Yes, it is possible to make money in stock trading. Many people have made millions just by day trading. Some examples are Ross Cameron, Brett N. Steenbarger. 4% of people were able to make a living with adequate capital, access to mentors, and practicing multiple hours every day during the week. · Roughly 10% to 15%. There are many confident online reports that a day trader can return profits of 10 percent each month, or no, wait, that's 18 percent per month or you get. Yes, day trading can be very lucrative. If you know what you are doing, it is possible to make a significant amount of money in a short time period. It can also. Can you make money with day trading? Discover practical tips & helpful strategies to be successful in day trading! Day trading as a side hustle is totally possible and can be very profitable but it's not easy and you need to put in the work! You know, before you do those. If you want to make your money work be a" trader" but never a "day trader." I trade plus times a year and mostly make money which I could live on. Back. Day trading is buying and selling stock within the same trading day. A day trader aims to profit from the market's daily moves. Surprisingly, the moves don't. Do you actively trade stocks? If so, it's important to know what it means to be a "pattern day trader" (PDT) because there are requirements associated with. Yes, it is possible to make money in stock trading. Many people have made millions just by day trading. Some examples are Ross Cameron, Brett N. Steenbarger. 4% of people were able to make a living with adequate capital, access to mentors, and practicing multiple hours every day during the week. · Roughly 10% to 15%.

Leveraged investing may increase a day trader's profit if a stock's price or the market moves in the right direction. However, using a leveraged investment. Finally, when selecting a brokerage, day traders will find that a brokerage's typical account minimums do not apply to them. Instead, pattern day traders must. Let me show you how I (a novice) navigate the stock market and build wealth with Etoro. Disclaimer: Please note, this is NOT financial advice. Day trading is buying and selling stock on the same day, hoping to make money in a short time by watching prices closely. · Tax consequences and other risks can. Individual day traders make money by buying and selling stocks, currencies, or other financial instruments within the same trading day. Don't be impatience to earn big profits. Always start with a small investment. Don't go for more than two stocks during a session. Never think that you will. How To Day Trade Stocks For Profit is a complete course designed to get you quickly making money from the stock market. No previous trading experience is. According to some studies I have covered on this website, most day traders will never make any money (and probably no other way either unless investing for the. Day traders with strong past performance go on to earn strong returns in the future. Though only about 1% of all day traders are able to predictably profit net. You need to scan the night before, create a watch list, and prepare to execute your trading plan the next day. Stock Scanners. 2. Wake Up Early and Check Pre-. Day trading refers to buying and selling securities and stocks, then selling them within the same day with the goal of making a profit. At the close of the. More than 80% of day traders quit within two years. To succeed in making money with stock trading, you'll need to do something different — create a. Most day traders lose money because they don't have the right tools and strategies. If you want to make consistent profits, you need to put in. Targets Trading Pro is an example of a futures trading solution. It uses the power of algorithmic trading to help you make money. Step 1. Choose What You Will. Day trading involves making short-term trades with stocks or other securities in an effort to make a profit. Other strategies may involve longer-term. Most Day Trade Fun students begin with a portfolio of $3, or less! Yes, you can day trade with a portfolio of this size, and we do it daily. Unlimited day. These individuals are known as day traders. They rose to prominence in the s as the development of inexpensive desktop computers and software programs made. If you buy and sell (or sell and buy) a security within the same day, you are day trading. Day traders leverage fluctuations in an asset's daily price with a. However, a day trader with the legal minimum of $25, in their account can buy $, (4× leverage) worth of stock during the day, as long as half of those. Investing Basics: Stocks. Stocks are one of the Learn some of the basic entry and exit signals and money management techniques used in swing trading.

Best Business Line Of Credit Rates

OnDeck offers a business line of credit that allows you to withdraw what you need when your business needs it. Lines of credit from $6K - $K. Small Business Lending Rates are only available to loans originating through the Retail Community Bank channel. Origination and other fees may apply. Other loan. Business line of credit rates and fees. Current business line of credit rates can range from 10% to 99% APR. The interest rate you receive will vary based on. No Cost, No Obligation, Hour Approvals Same Day Funding. Get $10, to $2M Now! Get Started. A business line of credit is an unsecured or revolving loan. Learn about the factors to consider when choosing a business line of credit, compare current rates, and get tips for applying for one in Canada. A business line of credit can be a good idea, allowing you to borrow only what you need for short-term expenses and pay interest only on that sum. Compare the Best Business Lines of Credit ; American Express Business Line of Credit Best for Backed by American Express, %–% ; Lendio Business Line of. A business line of credit is a flexible financing option you can draw from as needed. Interest is only charged on the amount of money you borrow. Best for flexibility: Bluevine Business Line of Credit · Best from a big bank: Wells Fargo BusinessLine · Best secured line of credit: American Express® Business. OnDeck offers a business line of credit that allows you to withdraw what you need when your business needs it. Lines of credit from $6K - $K. Small Business Lending Rates are only available to loans originating through the Retail Community Bank channel. Origination and other fees may apply. Other loan. Business line of credit rates and fees. Current business line of credit rates can range from 10% to 99% APR. The interest rate you receive will vary based on. No Cost, No Obligation, Hour Approvals Same Day Funding. Get $10, to $2M Now! Get Started. A business line of credit is an unsecured or revolving loan. Learn about the factors to consider when choosing a business line of credit, compare current rates, and get tips for applying for one in Canada. A business line of credit can be a good idea, allowing you to borrow only what you need for short-term expenses and pay interest only on that sum. Compare the Best Business Lines of Credit ; American Express Business Line of Credit Best for Backed by American Express, %–% ; Lendio Business Line of. A business line of credit is a flexible financing option you can draw from as needed. Interest is only charged on the amount of money you borrow. Best for flexibility: Bluevine Business Line of Credit · Best from a big bank: Wells Fargo BusinessLine · Best secured line of credit: American Express® Business.

Alpine Bank offers some of the best small business line of credit choices in CO. $ annual fee; Five-year maturity on lines of credit greater than. Keep your business moving. · Lines from $, to $1 million · Revolving line of credit that renews annually · Interest-only monthly payments · % rate. A business checking line of credit (CLOC) is a credit product with a fixed rate of % APR. CLOC repayment terms are 2% of the outstanding balance or $ credit, good business credit, and a track record of generating business lines of credit typically have lower interest rates than business credit cards. For BusinessLine line of credit, your rate will be between Prime + % and Prime + % depending on your personal and business credit evaluation. Prime. Your line of credit can help you cover everyday business expenses. Borrow funds whenever you need them, up to your approved credit limit. Secured lines may offer lower interest rates depending on your business profile and credit history. What is Best For Your Business. Normal credit. Best for Businesses seeking an unsecured line of credit. · Line of credit amounts between $20, and $, · Loan application and decisioning process –. First Commonwealth Bank proudly offers top local banking solutions in our communities of Pennsylvania and Ohio, including banks in Altoona, Canton, Cincinnati. Note: Secured line of credit also available at competitive interest rates. What type of credit line is best for small business? Here's what to know. Apply for credit lines up to $, and only pay for what you use, with rates as low as % for top qualifying customers and no maintenance fees. 2. blue. All accounts must be in good standing. Based upon analysis of application, appraisal and origination fees, and interest rates, for competing U.S. lenders as. You can hire seasonal help or offer signing bonuses to attract top talent, update equipment or order supplies, or stock up on additional inventory when prices. Find the best business line of credit options available from U.S Bank, and Interest rates are typically lower than a line of credit; Interest is. No one knows your business better than you do. Our fixed- and variable-rate credit line options can help you grow your business, cover short-term cash flow. Preferred Rewards for Business members can get an interest rate discount of %% for new Business Advantage credit lines, term loans and secured lending. Flexible financing for your business · Business financing from $5, to $, · Terms from months · Monthly interest rate %** · Weekly or monthly. Popular Bank offers business loans and business lines of credit up to $ Talk to a banker to find the best business financing option for you. It's a great way to stabilize your cash flow and give you peace of mind. Lines of Credit rates are variable and subject to change daily based on. Cons of a Business Line of Credit. However, with Business Lines of Credit, you typically need good credit to qualify, and you may receive a higher interest rate.

Republic Services Mobile Alabama

This company offers full service waste disposal & recycling services. close. Business Details. Location of This Business: Varner Dr, Mobile, AL MOBILE, Ala., Oct. 25, /3BL Media/ – Republic Services and the Alabama Coastal Foundation were recognized by the National Waste & Recycling Association. Need to rent a dumpster? Explore our dumpster rental services near Mobile, AL. Get information on dimensions, pricing, ordering, pickup, and delivery. The Lower Gwynedd Township Board of Supervisors awarded the bid for Trash Collection Services to Republic Services at their meeting on September 22, The. The City of Richmond's solid waste and recycling services are provided by two agreements with Republic Services: a collection franchise agreement managed by. Mobile Transcyclery is located at Varner Drive, Mobile, AL Republic Services, Inc is the second largest provider non-hazardous solid waste. Contact Republic Services for answers to your important questions. Find phone numbers, facilities, contact forms, and more. Pay your bill, manage your account or schedule extra service using My Resouce from Republic Services. Sign in or sign up today to manage your account. Get more information for Republic Services in Mobile, AL. See reviews, map, get the address, and find directions. This company offers full service waste disposal & recycling services. close. Business Details. Location of This Business: Varner Dr, Mobile, AL MOBILE, Ala., Oct. 25, /3BL Media/ – Republic Services and the Alabama Coastal Foundation were recognized by the National Waste & Recycling Association. Need to rent a dumpster? Explore our dumpster rental services near Mobile, AL. Get information on dimensions, pricing, ordering, pickup, and delivery. The Lower Gwynedd Township Board of Supervisors awarded the bid for Trash Collection Services to Republic Services at their meeting on September 22, The. The City of Richmond's solid waste and recycling services are provided by two agreements with Republic Services: a collection franchise agreement managed by. Mobile Transcyclery is located at Varner Drive, Mobile, AL Republic Services, Inc is the second largest provider non-hazardous solid waste. Contact Republic Services for answers to your important questions. Find phone numbers, facilities, contact forms, and more. Pay your bill, manage your account or schedule extra service using My Resouce from Republic Services. Sign in or sign up today to manage your account. Get more information for Republic Services in Mobile, AL. See reviews, map, get the address, and find directions.

Republic Services is an innovative leader in the environmental services industry. From recycling and waste to environmental solutions, we're partnering with. 1 Fave for Republic Services from neighbors in Mobile, AL. Connect with neighborhood businesses on Nextdoor. Republic Services. | 0 Verified Ratings. Write A Review · Write a Review. () Varner Dr. Mobile, AL, PSA: Republic Services | Early Start | 04/19/24 ______ ⚠️⏰ Anniston residents, due to the likelihood of traffic congestion on Speedway. Get reliable, responsible environmental service solutions. Republic Services also offers residential, commercial, and industrial trash pickup and recycling. Sales Manager · Experience: Republic Services · Location: Mobile · connections on LinkedIn Mobile, Alabama, United States. Clean Harbors Graphic. Business. Sales Manager · Experience: Republic Services · Location: Mobile · connections on LinkedIn Mobile, Alabama, United States. Clean Harbors Graphic. Business. Sign-up seamlessly with Republic Services for all your waste removal & garbage collection needs. Always on-time and safe. Let's get started! Republic Services - Varner Dr Mobile, AL Local Recycling Centers and Recycling Information and Statistics. Do more with the touch of a button with the Republic Services app. With the Republic Services app, you can access all of your account management features. Sign up for residential trash & garbage service, check pickup schedules, holiday service or manage your account. It's easy with Republic Services. We work to exceed your expectations with quality containers, safe and reliable pickup, and outstanding customer service. Contact us today to learn more about. Find a Republic Services landfill, recycling facility, or transfer station near you. We have options to meet your disposal needs & help you achieve your. What size dumpsters do you offer? Where should I place my cart? What can I recycle? Will holidays delay my service? Icon finger on mobile device with a star. Republic Services makes it easy to recycle at home. Learn how our reliable curbside recycling and solid waste services can help you make a positive. Customer Service, call center. Answer inbound calls and resolve from residential and commercial customers. Anywhere from 50 to 65 calls a day from many. Yard Dumpster. For heavy materials, available in box and tub. Dimensions. 12'8" L x 8'3" W x 4'4" H. Capacity. 60 gallon trash bags; 4 standard pickup. Apply for Diesel Maintenance Shop Technician A job with Republic Services in Mobile, Alabama, Maintenance at Republic Services. Republic Services jobs in alabama · non cdl driver · Driver - CDL (B) · Landfill General Laborer Incentive · Roll Off Driver-Manual Transmission Experience -. Republic Services Mobile, AL. 1 month ago Be among the first 25 applicants. See who Republic Services has hired for this role. No longer accepting applications.

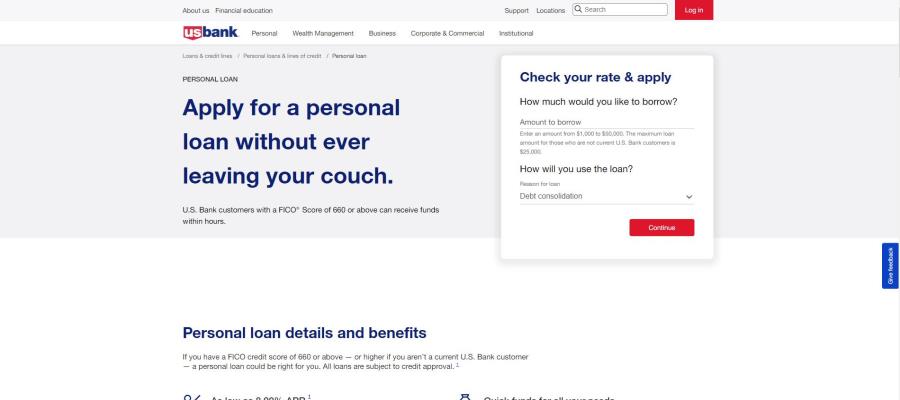

Top Banks For Personal Loans

Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from loans with fixed interest rates that can be used for many major life events. Bank Smarter with LendingClub. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior. The best banks for personal loans are Discover, American Express, Wells Fargo and Citibank. These banks are great for personal loans because they provide the. From buying new appliances to consolidating debt, First Hawaiian Bank can help you get there with a personal loan in Hawaii. Those big purchases you've been waiting on. Taking control of your finances. Get the money to make your dreams possible with a personal loan at a. KeyBank Personal Loan · Fixed rates you can budget around · Low interest to help you save money monthly · Flexible terms with up to 84 months to pay. SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for poor credit. · Prosper: Best peer-to-peer lender. · Axos Bank: Best for excellent. The study gathered responses from nearly 13, banking customers from August to September It found that Capital One, Chase, and TD Bank were ranked. Upgrade your home and its value. U.S. Bank personal checking clients with credit approval may borrow up to $50, with our home improvement personal loan. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from loans with fixed interest rates that can be used for many major life events. Bank Smarter with LendingClub. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior. The best banks for personal loans are Discover, American Express, Wells Fargo and Citibank. These banks are great for personal loans because they provide the. From buying new appliances to consolidating debt, First Hawaiian Bank can help you get there with a personal loan in Hawaii. Those big purchases you've been waiting on. Taking control of your finances. Get the money to make your dreams possible with a personal loan at a. KeyBank Personal Loan · Fixed rates you can budget around · Low interest to help you save money monthly · Flexible terms with up to 84 months to pay. SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for poor credit. · Prosper: Best peer-to-peer lender. · Axos Bank: Best for excellent. The study gathered responses from nearly 13, banking customers from August to September It found that Capital One, Chase, and TD Bank were ranked. Upgrade your home and its value. U.S. Bank personal checking clients with credit approval may borrow up to $50, with our home improvement personal loan.

Best Personal Loans of August · Best Personal Loan Lenders · SoFi · LightStream · PenFed Credit Union · Avant · Prosper · Discover · First Tech Federal Credit. Our personal loans are a smart way to take care of unexpected or large expenses without relying on high-interest credit cards. Community banking at its finest. Offering personal and business banking solutions including loans, mortgages, wealth management, credit cards. First Commonwealth Bank proudly offers top local banking solutions in our communities of Pennsylvania and Ohio, including banks in Altoona, Canton. Based on our systematic rating and review process, Citibank, Discover, Laurel Road, PNC Bank, SoFi, USAA and Wells Fargo are the best banks for personal loans. Best for home improvement: LightStream. Why LightStream stands out: LightStream — the online lending division of Truist Bank — offers personal loans ranging. With Popular Bank personal loan, and lines of credit you can get financing to consolidate your debt or go on that well-deserved vacation. Best for Large Amounts: SoFi SoFi logo. With a $, limit, SoFi personal loans are best suited for those who need to borrow more than what most other. Borrow the money you need for a big purchase or to reach your financial goal. Whether you're looking to consolidate debt, refinance a loan or to pay for a. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. Compare the Best Personal Loans From Banks for · Best Overall: U.S. Bank · Best for Debt Consolidation: Discover · Best for Fast Funding: Citibank · Best. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Best Banks for Personal Loans ; U.S. Bank, Overall, $1, to $50, ; Discover, Debt consolidation, $2, to $40, ; Citibank, Fast funding, $2, to $30, Customers Bank offers the best personal loans for individuals with good credit. Evaluate our flexible financing options, such as our 3- and 5-year terms and. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. American Express may be known for its credit cards, but with low rates and no origination fees, American Express ranked as one of the best personal loan lenders. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! Alpine Bank's lending experts is committed to helping you find personal loans. Apply online or in-person at one of our many Colorado locations. When you need a personal loan, banks like Customers Bank, credit unions, and online lenders offer various financing options. We offer competitive interest. What would you like the power to do? For you and your family, your business and your community. At Bank of America, our purpose is to help make financial.

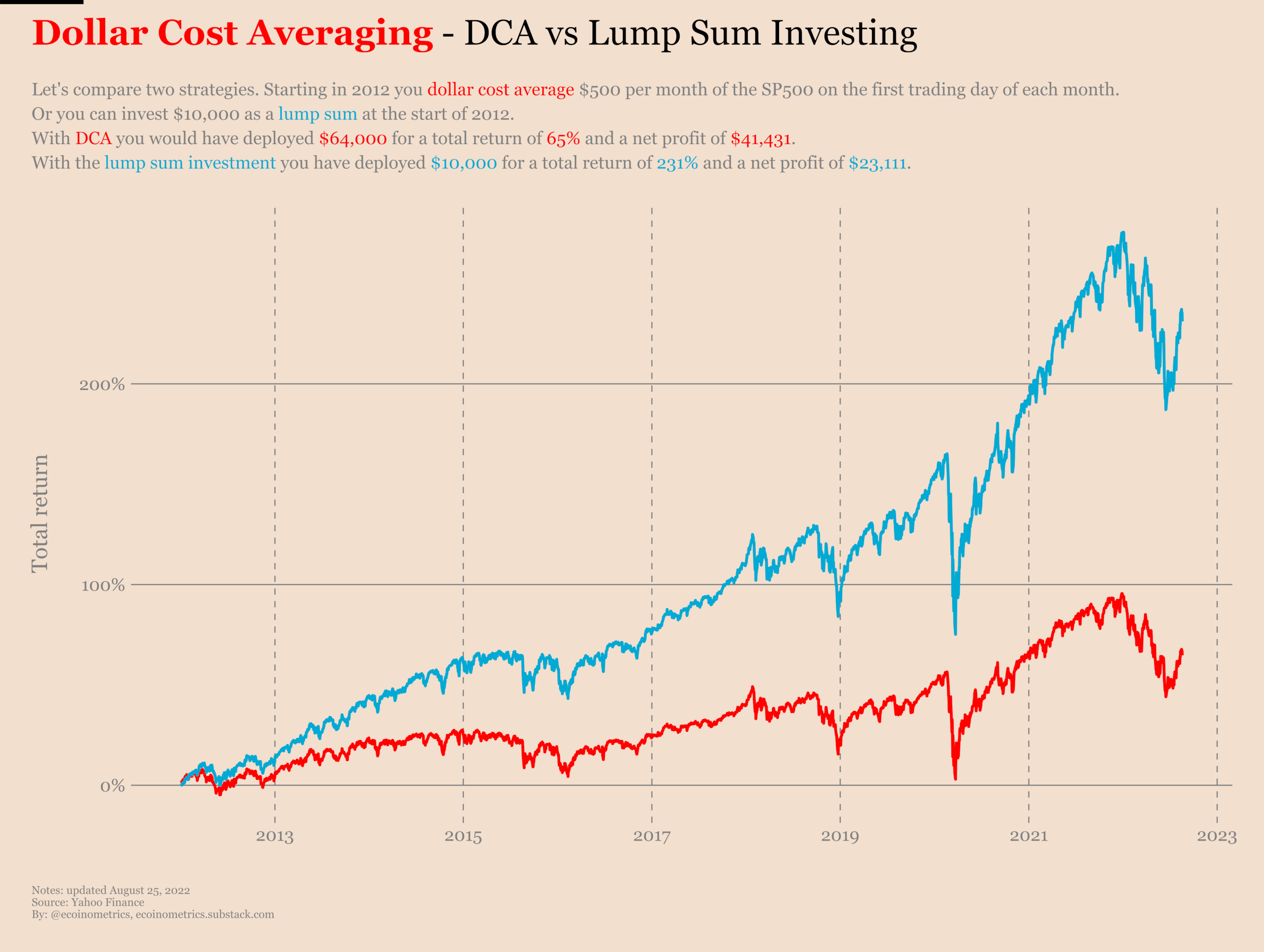

Dollar Cost Averaging Brokerage

Dollar cost averaging is a strategy in which investment positions are built by investing equal sums of money at regular intervals, regardless of the asset's. Dollar-cost averaging through an automatic investing program offers investors an alternative approach, allowing them to enter the market gradually — and perhaps. Dollar cost averaging is a strategy to manage price risk when you're buying stocks, exchange-traded funds (ETFs) or mutual funds. Instead of purchasing shares. Why choose dollar-cost averaging (DCA)?. The rationale behind DCA is that you will naturally purchase more shares when prices are lower and fewer shares when. Consider dollar-cost averaging If you're looking to get started investing but don't know how, consider dollar-cost averaging. Here's how it works: every month. Systematic (automatic recurring or dollar cost averaging) transactions, no fee; minimum transaction $ Bonds and CDs. U.S. TREASURY SECURITIES. NEW ISSUES. Dollar-cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or. Dollar-cost averaging means investing your money in equal portions, at regular intervals, regardless of the ups and downs in the market. This investment. For example: If using CMC then the brokerage is free for the first buy of each day up to 1K per buy, per ticker. If you decided to work your. Dollar cost averaging is a strategy in which investment positions are built by investing equal sums of money at regular intervals, regardless of the asset's. Dollar-cost averaging through an automatic investing program offers investors an alternative approach, allowing them to enter the market gradually — and perhaps. Dollar cost averaging is a strategy to manage price risk when you're buying stocks, exchange-traded funds (ETFs) or mutual funds. Instead of purchasing shares. Why choose dollar-cost averaging (DCA)?. The rationale behind DCA is that you will naturally purchase more shares when prices are lower and fewer shares when. Consider dollar-cost averaging If you're looking to get started investing but don't know how, consider dollar-cost averaging. Here's how it works: every month. Systematic (automatic recurring or dollar cost averaging) transactions, no fee; minimum transaction $ Bonds and CDs. U.S. TREASURY SECURITIES. NEW ISSUES. Dollar-cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or. Dollar-cost averaging means investing your money in equal portions, at regular intervals, regardless of the ups and downs in the market. This investment. For example: If using CMC then the brokerage is free for the first buy of each day up to 1K per buy, per ticker. If you decided to work your.

Dollar cost averaging involves making regular investments of a fixed amount over a period of time. Instead of attempting to time the market, you buy in at a. Dollar cost averaging (DCA) is an investment strategy that aims to apply value investing principles to regular investment. The term was first coined by. The idea of dollar-cost averaging is to invest your dollars in a stock, exchange-traded fund (ETF) or other security in regular, equal portions over time. Sure. Dollar-cost averaging does not ensure a profit in rising markets or protect against a loss in declining markets. This type of investment program involves. Dollar cost averaging can help reduce the impact of volatility and spares you from having to decide when to invest. Learn how to get started. Consistent investing in action. BUILDING YOUR SHARES. REDUCING YOUR COST. Over the long term, consistently investing a constant dollar amount through all. Dollar cost averaging is a basic investment strategy where you buy a fixed dollar amount of an investment on a regular cadence. Learn more. Dollar cost averaging works by making more or less the same investment over and over on a repeating basis. For an investor, it may be as simple as investing $5. Dollar cost averaging is a long-term investment strategy wherein you spread out your equity purchases (stocks, funds, etc.) over regular buying intervals and in. The aim of dollar cost averaging is to reduce the impact of volatility – the rate at which the price of a security increases or decreases. When the price goes. So how does it work? With dollar cost averaging, you steadily build your portfolio by investing a fixed dollar amount at regular intervals. By investing on a. Dollar-cost averaging consists of buying more shares of a stock when prices are low and buying fewer shares when prices are high. This can result in spending. Without fractional shares, you'd have to save up money to buy a single share of a large company with a $1, share price. Combining fractional share purchases. When an investor applies dollar-cost averaging (DCA), they invest the money in equal portions at periodic intervals, regardless of the market conditions. This. How does dollar-cost averaging work? Dollar cost averaging involves investing the same amount of money at regular intervals, for example monthly or quarterly. Dollar-cost averaging (DCA) is a strategy where you invest your money I essentially use my brokerage account as checking, so every penny. Dollar Cost Averaging works by spreading the total investment across multiple smaller purchases. Instead of investing a lump sum all at once, an investor. Which Broker is the cheapest to use if I want to Dollar cost Average (SGD1, every month into US ETF and hold for at least 5years? Total amount is less than . Dollar-cost averaging (DCA) is an investment strategy in which the intention is to minimize the impact of volatility when investing or purchasing a large block. Brokerage firms that offer auto stock buying for dollar cost averaging. Hello all I have seemingly been on a endless missions on.

How To Invest The Money In Share Market

It prevents you from investing all of your money near what could be a stock-market top, seeing the value of your investment drop, then having to sell at a. There are various brokers in the market such as manipulyator-odintsovo.ru, Groww, AngelOne, Zerodha etc. Open an demat account via the broker app. After opening. Secondly, they can receive a loan, but it increases interest payment, which is a liability. Instead, the company decides to launch shares in the market. How to invest in stock market without knowledge and little money? · 1. Do your research · 2. Talk to friends/family · 3. Open a Demat Account · 4. Have a clear goal. Exchange Traded Funds trade on a stock exchange like shares. However unlike shares, which are focused on one company, ETFs invest in a range of assets and are. shares outstanding by the price per share. Cash equivalent - A short-term money-market instrument, such as a Treasury bill or repurchase agreement, of such. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. 1. Select a reputable broker · 2. Open a Demat and trading account · 3. Add funds and log in to your trading account · 4. Choose the stock to invest in · 5. Decide. It prevents you from investing all of your money near what could be a stock-market top, seeing the value of your investment drop, then having to sell at a. There are various brokers in the market such as manipulyator-odintsovo.ru, Groww, AngelOne, Zerodha etc. Open an demat account via the broker app. After opening. Secondly, they can receive a loan, but it increases interest payment, which is a liability. Instead, the company decides to launch shares in the market. How to invest in stock market without knowledge and little money? · 1. Do your research · 2. Talk to friends/family · 3. Open a Demat Account · 4. Have a clear goal. Exchange Traded Funds trade on a stock exchange like shares. However unlike shares, which are focused on one company, ETFs invest in a range of assets and are. shares outstanding by the price per share. Cash equivalent - A short-term money-market instrument, such as a Treasury bill or repurchase agreement, of such. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. 1. Select a reputable broker · 2. Open a Demat and trading account · 3. Add funds and log in to your trading account · 4. Choose the stock to invest in · 5. Decide.

Short selling. Main article: Short selling. In short selling, the trader borrows stock (usually from his brokerage which holds its clients shares or its own. Stock market simulators work by allowing you to pretend you are investing in real stocks but without using real money. Here are a few of the best options. How. A mutual fund pools money from many investors to buy stocks, bonds or other securities. A fund manager decides which securities to buy and sell inside the fund. share a portion of their financial success with investors through cash If you own a value stock, you're hoping the market eventually realizes the stock is. The most surefire way to make money in the stock market is to buy shares of great businesses at reasonable prices and hold on to the shares for as long as the. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need. Open an Account: Open a brokerage account to begin investing. Dollar-Cost Averaging: Invest regularly regardless of market conditions. Research. Market timing is when you move your money in and out of equities to try and capture the performance highs and avoid the lows. It's extremely risky, and even the. There are two ways to profit from stock investing: selling shares when their market value goes up and dividend payments. Dividends are payments in either cash. The first way is to buy stocks or other investments on an exchange, and then sell them at a higher price. Here's a simple example: If you buy shares of. When shares are first put on the market, you can buy them via a prospectus. You can also buy through an employee share scheme, or invest indirectly through a. In the share market, there are three main share investment options: 1. Exchange-traded funds – these represent investments that let you purchase small pieces of. DIY investing · How to invest £50, If you have come into a £50, windfall, investing your money in the stock market can offer higher returns · Investment. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments. Dollar cost averaging. A way to invest by buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. · Market. To start investing in stocks, you would find a company that you like and think might grow in value and then purchase its stock through a brokerage account. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been.

Does Dillons Take Apple Pay

Save time and money when shopping in-store with the mobile app and Kroger Pay. Plus, read about how we're keeping our customers safe. I have worked as a seafood clerk for about six months and it is a great job. The pay is reasonable, management is kinds and understanding, schedules can be. Kroger now takes apple pay and I'm wondering if they accept the instacart mobile card? Has anyone tried it since Kroger made the switch to accepting apple pay? Add your Plus Card to Wallet for iPhone. To use the Dillons app, you'll need a Dillons digital account. You can create one and link your Plus Card through the. This item does not ship during warm or hot weather due to it containing chocolate. Shipping included. Shipping & Returns. Apple Pay Google Pay Visa Mastercard. Google Pay is accepted at millions of places around the world. You can use it in apps, on the web, and in stores. See our featured apps, sites, and stores. Add your Plus Card to Wallet for iPhone. To use the Dillons app, you'll need a Dillons digital account. You can create one and link your Plus Card through the. Kroger Pay transactions at Fuel Centers do not earn rewards. "Mobile wallet" is defined as the method of paying for transactions using Apple Pay®, Samsung Pay. Pay In-person · Debit Card · MasterCard, Visa, American Express, Discover · Apple Pay, Google Pay, Samsung Pay · Cash, Money Order, Personal Check, Traveler's Check. Save time and money when shopping in-store with the mobile app and Kroger Pay. Plus, read about how we're keeping our customers safe. I have worked as a seafood clerk for about six months and it is a great job. The pay is reasonable, management is kinds and understanding, schedules can be. Kroger now takes apple pay and I'm wondering if they accept the instacart mobile card? Has anyone tried it since Kroger made the switch to accepting apple pay? Add your Plus Card to Wallet for iPhone. To use the Dillons app, you'll need a Dillons digital account. You can create one and link your Plus Card through the. This item does not ship during warm or hot weather due to it containing chocolate. Shipping included. Shipping & Returns. Apple Pay Google Pay Visa Mastercard. Google Pay is accepted at millions of places around the world. You can use it in apps, on the web, and in stores. See our featured apps, sites, and stores. Add your Plus Card to Wallet for iPhone. To use the Dillons app, you'll need a Dillons digital account. You can create one and link your Plus Card through the. Kroger Pay transactions at Fuel Centers do not earn rewards. "Mobile wallet" is defined as the method of paying for transactions using Apple Pay®, Samsung Pay. Pay In-person · Debit Card · MasterCard, Visa, American Express, Discover · Apple Pay, Google Pay, Samsung Pay · Cash, Money Order, Personal Check, Traveler's Check.

manipulyator-odintsovo.ru offers a variety of payment methods. Customers can use payment cards for their purchases. The website also supports mobile wallet payments, which. Sign up for reloadable prepaid cards with Kroger to make convenient payments in-store and online. Discover reloadable prepaid cards today at your local. Customers can also use Kroger Pay Kroger recently launched an NFC contactless payment (e.g., Apple Pay and Google Pay) pilot in our Pacific Northwest QFC. all of their stores are. Does Dillons Take Apple Pay Wallet & Apple Pay. Dillons doesnt want you using a. additional retailers and venues with. Kroger Pay is a fast, contact-free, safe way to pay and save using your mobile device at participating in store and fuel center locations in the Kroger. doxo enables secure bill payment on your behalf and is not an affiliate of or endorsed by Dillons Mastercard. Pay with your Visa, MasterCard. use of a mobile device (in a store, in-app or online) and includes Apple Pay®, Samsung Pay, Google Pay™, Garmin Pay™ and LG Pay®. If the transaction is an. with the freshest candy. Shipping included. Shipping & Returns. Apple Pay Google Pay Visa Mastercard American Express Discover JCB CashApp Afterpay Paypal. Supermarkets – Kroger, Ralphs, Dillons, Smith's, King Soopers, Fry's, QFC, City Market, Owen's, Jay C, Pay Less, Baker's, Gerbes, Harris Teeter, Pick 'n Save. "Mobile wallet" is defined as the method of paying for transactions using Apple Pay®, Samsung Pay, Google Pay™ or Garmin Pay™. If a Kroger Pay or Mobile Wallet. We also accept Near Field Communication (NFC) payments, Apple Pay, Google Pay and Samsung Pay inside our clinics. Send and pick up money, cash payroll and government checks, pay bills, get a money order and more at a Dillons Food Stores Money Services near you. Everybody is stretched so thin yet we get sent home for overtime, leaving mountains of work for other people to do. I am genuinely surprised we keep making this. A free inside look at Dillons salary trends based on 22 salaries wages for 18 jobs at Dillons. Salaries posted anonymously by Dillons employees. have privacy and information security policies that differ from those of manipulyator-odintsovo.ru Kroger Pay transactions at Fuel Centers do not earn rewards. Apple Pay®, Samsung Pay, Google Pay™ or Garmin Pay™. If a Kroger Pay or 7 When you use Kroger Pay with a Kroger Payments card. For more. The estimated total pay range for a Online Grocery Pickup at Dillons is $13–$16 per hour, which includes base salary and additional pay. For your convenience, we offer Online Pay through our website and app. We also accept many different forms of payment in-person at the pharmacy. You may also. Your trust is our top concern, so businesses can't pay to alter or remove their reviews. does post office work. It used to be my one stop and go.

Prevailing Car Loan Interest Rates

CIBC car loan. Interest rate as a percentage. Interest is the money you pay to Current language: English Opens in a dialog. CDIC Deposit Insurance. Auto Loans Interest Rates ; Certified Pre-owned Car Loan Scheme. From % to % (CIC Based rates are applicable). ; SBI Two-Wheeler Loan. % to %. Today's New & Used Car Loan Rates ; %, %, %, N/A ; Rates as of Sep 13, ET. Your APR will be determined based on creditworthiness, length and amount of loan, and age of collateral. For auto loans, new rates apply to the current vehicle. Auto loan rates as low as % APR*. We take away the stress of financing a car or motorcycle with the most competitive rates out there. Apply online 24/7. Vehicle Loan Rates ; Auto, New, , % ; Auto, New · , %. Borrow better with a private sale vehicle loan. We offer fixed and variable interest rates, along with a repayment schedule that fits your budget. Enter the vehicle price, down payment, and interest rate into our car finance calculator below. Use the car auto loan calculator and input your current amount. Easily calculate your payment amount with our Car Loan Calculator and see how your interest rate, down payment and financing term could affect your payments. CIBC car loan. Interest rate as a percentage. Interest is the money you pay to Current language: English Opens in a dialog. CDIC Deposit Insurance. Auto Loans Interest Rates ; Certified Pre-owned Car Loan Scheme. From % to % (CIC Based rates are applicable). ; SBI Two-Wheeler Loan. % to %. Today's New & Used Car Loan Rates ; %, %, %, N/A ; Rates as of Sep 13, ET. Your APR will be determined based on creditworthiness, length and amount of loan, and age of collateral. For auto loans, new rates apply to the current vehicle. Auto loan rates as low as % APR*. We take away the stress of financing a car or motorcycle with the most competitive rates out there. Apply online 24/7. Vehicle Loan Rates ; Auto, New, , % ; Auto, New · , %. Borrow better with a private sale vehicle loan. We offer fixed and variable interest rates, along with a repayment schedule that fits your budget. Enter the vehicle price, down payment, and interest rate into our car finance calculator below. Use the car auto loan calculator and input your current amount. Easily calculate your payment amount with our Car Loan Calculator and see how your interest rate, down payment and financing term could affect your payments.

As of , the average interest rate for car loans was percent for new cars and percent for used cars. However, these rates are just averages—you. Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. Auto Loan Rates ; %, $10, ; %, $20, ; %, $35, ; First Time Auto Buyer ( or newer), %, $7, What is the average interest rate on a car loan and what is a good interest rate for a car loan? Most Toyota interest rates can run between % and %. Average Auto Loan Rates in July ; or higher, %, % ; , %, % ; , %, % ; , %, %. The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles. Car & Truck Loan Rates ; 1–36 months, %, $ ; 37–51 months, %, $ car loan, monthly payment, interest rate, and trade-in value How much is left on your current vehicle loan? If you don't have a loan. Classic Car Loan Rates ; 36 - 60 Months, % - % ; 61 - 72 Months, % - %. Current Rates ; 1 - 63 Months, % ; 64 - 75 Months, % ; 76 - 84 Months, % ; 85 - 96 Months, %. Rates – Auto and leisure vehicle loans ; %. Lenders use two ways to calculate interest rates on auto loans – simple or precomputed interest. An auto loan with simple interest is calculated based on your. Compare auto loan rates in September ; Bank of America, Starting at %, months ; Capital One, Not specified, months ; Carvana, %%, Interest rate (%) Your interest rate. Interest rate (%) Your interest rate. See our current rates. Calculate payment for vehicle loan button. Adjust the loan. Get on the road with low interest rates ; Model Year, 66 Months, % APR ; Model Year, 72 Months, % APR ; Model Year, 48 Months, Average Auto Loan Rates in July ; , %, %, % ; or lower, %, %, N/A. Current Rates. Auto Loans · Mortgage & Home Loans. Mortgage Construction The maximum interest rate for this loan type is 18% APR and the minimum loan. Car loan rates as low as % APR*. Take your instant online preapproval to a dealership; Low-rate loans with up to % car financing** (purchase price. View your current Vehicle Loan rates. ; Autos – New ( to ), % ; Autos – New ( to ), % ; Autos – Used (Model Year to ), %. Rates are 1% higher without AutoPay; maximum % APR. “New Auto and Truck” means the current and prior model year with less than 10, miles. “Used Auto and.

Should I Buy Comprehensive Car Insurance

Both coverages also have a deductible that must be met before repairs can be made. The main difference is that comprehensive coverage pays for losses and. Do I need “full coverage” car insurance? · You're financing a car. Lenders typically require “full coverage” in addition to other coverages required by the state. Comprehensive car insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. As mentioned above, comprehensive covers you if your car is damaged by everything from theft to natural disasters. You could say that collision is for when you. Do I need comprehensive insurance coverage? If you're leasing or financing a vehicle, your lender will likely require you to purchase comprehensive coverage. Comprehensive car insurance coverage covers non-collision-related damage to your vehicle, such as theft, fire or animal strikes. Learn more with Travelers. I always recommend comprehensive coverage to customers for a few reasons: * Less expensive than collision * Location and likelihood of. Yes, older cars are typically cheaper to insure because you may not need comprehensive and collision coverage and your vehicle's value will surely be less than. Comprehensive insurance is a type of auto insurance that can help provide financial protection if your car is damaged by something other than a crash. Both coverages also have a deductible that must be met before repairs can be made. The main difference is that comprehensive coverage pays for losses and. Do I need “full coverage” car insurance? · You're financing a car. Lenders typically require “full coverage” in addition to other coverages required by the state. Comprehensive car insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. As mentioned above, comprehensive covers you if your car is damaged by everything from theft to natural disasters. You could say that collision is for when you. Do I need comprehensive insurance coverage? If you're leasing or financing a vehicle, your lender will likely require you to purchase comprehensive coverage. Comprehensive car insurance coverage covers non-collision-related damage to your vehicle, such as theft, fire or animal strikes. Learn more with Travelers. I always recommend comprehensive coverage to customers for a few reasons: * Less expensive than collision * Location and likelihood of. Yes, older cars are typically cheaper to insure because you may not need comprehensive and collision coverage and your vehicle's value will surely be less than. Comprehensive insurance is a type of auto insurance that can help provide financial protection if your car is damaged by something other than a crash.

Comprehensive coverage is a type of auto insurance that will help compensate you should your vehicle need to be replaced or repaired due to an event that's not. Collision insurance and comprehensive insurance are optional. 3. What does physical damage insurance cover? Collision and comprehensive insurance pay for the. Why Should You Buy Auto Insurance? All drivers must have motor vehicle liability insurance. This mandatory requirement falls under the authority of the. Consider eliminating collision or comprehensive coverage on cars with little However, in order to make a claim, you must pay more before your coverage. Your vehicle holds a low value: As with collision, consider dropping comprehensive coverage if your vehicle's market value is lower than a few thousand dollars. Get Collision Comprehensive Coverage. Collision coverage protects your vehicle if it is damaged in an accident. Collision is sold with comprehensive coverage. What Is Comprehensive Car Insurance Coverage? · 1. File a claim. Head to the Lemonade app to start filing your car insurance claim. · 2. Assess options to repair. If your car is suddenly damaged or totaled, could you afford to repair or replace it? If the answer is no, you should get collision and comprehensive coverage. Comprehensive coverage can help protect your vehicle if something bad happens, like an accident or theft. Get coverage today & have peace of mind! When your car gets damaged from a covered accident, these coverages may help pay for the repairs needed to get your car back into pre-accident condition. In the. Comprehensive coverage helps cover the cost of damages to your vehicle when you're involved in an accident that's not caused by a collision. Comprehensive insurance coverage is defined as an optional coverage that protects against damage to your vehicle caused by non-collision events that are. Comprehensive auto insurance coverage helps pays to repair or replace a covered vehicle that's stolen or damaged by something other than collision. Comprehensive insurance is a type of auto insurance that can help provide financial protection if your car is damaged by something other than a crash. Even if you don't need it, comprehensive coverage may be worth it, especially if you can not comfortably pay to repair or replace your vehicle in the event that. On the other hand, comprehensive insurance can be extremely valuable if you have a new car. Out-of-pocket expenses for car repairs can be expensive, and having. Comprehensive covers damage to your car caused by disasters “other than collisions,” and costs significantly less than collision coverage. With the average cost. If your car is suddenly damaged or totaled, could you afford to repair or replace it? If the answer is no, you should get collision and comprehensive coverage. Comprehensive car insurance offers protection to the insured car against third-party liabilities and own damages due to unanticipated incidents such as fire. How Much Insurance To Buy and What Types of Coverage Do You Need? · Coverage for substitute transportation such as a rental car while your car is being repaired.

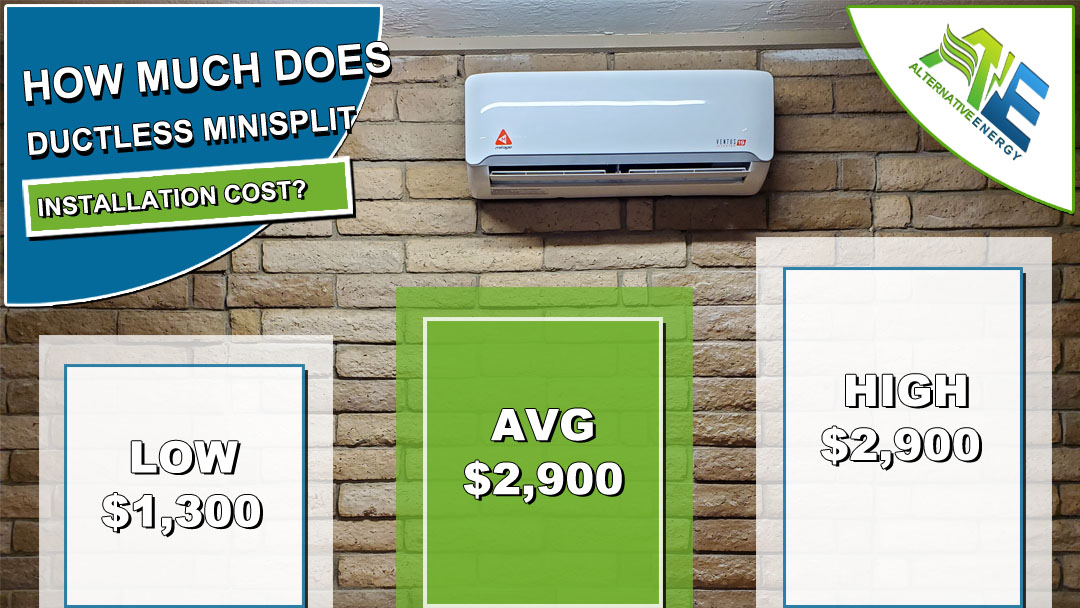

Cost To Install Ductless Hvac

The average cost of installing a ductless system with a single indoor heating/cooling zone starts at about $8,, depending on the customer's needs and choice. A ductless air conditioning system is the perfect option for cooling a home or business that does not have ductwork. The price for installation of these units. etc, The average cost is $ per head. to buy and install. yes u will always have the maint. guy or handy man locally that will do it for. HVAC installation costs typically range from $ to $10,, but homeowners will pay around $5, on average. A window air conditioning unit can cost as. The cost of purchasing and installing a ductless heat pump system generally starts around $ for a single head system, and can vary depending on factors. Here in Pennsylvania, New Jersey, and Delaware, a mini-split installation costs around $5, for a single-zone, air conditioning. Ductless mini-split air conditioners must be installed by HVAC technicians, so you'll need to budget for professional installation on top of unit costs. For a. How much does it cost to install a mini split? The average mini split installation cost is $ in the US, and we break down all the costs that go into. You should typically expect to pay anywhere from $1, to $15, for the ductless system itself plus an additional $1, to $10, for the installation and. The average cost of installing a ductless system with a single indoor heating/cooling zone starts at about $8,, depending on the customer's needs and choice. A ductless air conditioning system is the perfect option for cooling a home or business that does not have ductwork. The price for installation of these units. etc, The average cost is $ per head. to buy and install. yes u will always have the maint. guy or handy man locally that will do it for. HVAC installation costs typically range from $ to $10,, but homeowners will pay around $5, on average. A window air conditioning unit can cost as. The cost of purchasing and installing a ductless heat pump system generally starts around $ for a single head system, and can vary depending on factors. Here in Pennsylvania, New Jersey, and Delaware, a mini-split installation costs around $5, for a single-zone, air conditioning. Ductless mini-split air conditioners must be installed by HVAC technicians, so you'll need to budget for professional installation on top of unit costs. For a. How much does it cost to install a mini split? The average mini split installation cost is $ in the US, and we break down all the costs that go into. You should typically expect to pay anywhere from $1, to $15, for the ductless system itself plus an additional $1, to $10, for the installation and.

National Average. The average cost to install a ductless mini split is approximately $2, · Professional Know-How. HVAC contractors are trained professionals. Minisplit Installation cost in Colorado ranges from $ - $ on average. Use our free online calculator to estimate mini-split installation cost. The cost of a Carrier ductless mini-split installation near Oxford, PA, completely installed and ready to turn on starts at about $ for a single-zone. In this podcast, Mike Cappuccio, the founder of NETR, talks about the cost of installing a wall-mounted ductless AC. As of , the cost starts at around. That being stated, installed costs might range anywhere between $2, to $10, or more. That's quite a range! The good news is there are a number of ways to. In Denver, the price to install a mini-split system can range anywhere from $ to $15,, respectively. Let us take a closer look at. Mini split installations cost around $6, for a single-zone system, air conditioning-only, and up to $45, or more for whole-home heat pump solutions that. Number of zones. The average cost of a single-zone mini-split system is from $ to $1, The average cost of a multi-zone ductless system with two handlers. The average cost to install a ductless heat pump is about $ (2-zone BTU V ductless mini-split heating and cooling unit, installed). Since we are a HVAC company who actually installs mini splits, we want to share some specific numbers with you. Our most common installation is a 24, BTU or. Cost Breakdown of Ductless AC Installation When thinking about getting a ductless AC system, you'll probably pay between 3, and 5, on average. The final. The amount you pay to purchase and install a ductless air conditioner in the US ranges from $3, to $5, or more (about $4, to $6, in Canadian dollars). Depending on how you design your system, its total price is likely to fall within a range that averages from $8, to $30, Your specific price range is. Typically, a ductless mini-split air conditioner installation costs around $8, This cost includes electrical work, permits, equipment, and parts. Older home. The reason for these cost differences is simple: more zones require more labor, equipment, and parts. The outdoor unit needed for heating and cooling gets. The cost of mini split installation can vary based on several factors including the brand, capacity, and complexity of the installation. On. Mitsubishi Mini Split Heat Pump System Cost can also vary from $3,$10, due to type of system, design, room size, zoning, installer cost & more! We are an. You see a broad range of factors in any one home's ductless AC cost. Quoted prices can easily swing $1, between different HVAC companies. Estimating. According to a recent article from Forbes Home, a typical mini split installation is going to cost somewhere between $2, and $14,, depending on the size. Average cost to install ductless air conditioning is about $ ( manipulyator-odintsovo.ru zone). Find here detailed information about ductless air conditioning costs.

2 3 4 5 6 7